Facebook and Instagram vs. TikTok Ads for Life Insurance Brokers: A Guide to Generating High-Intent, High-Net-Worth Annuity and IUL Leads

ACROPOLIS DIGITAL LLC | DECEMBER 9, 2024 | BY TREVOR BROWN

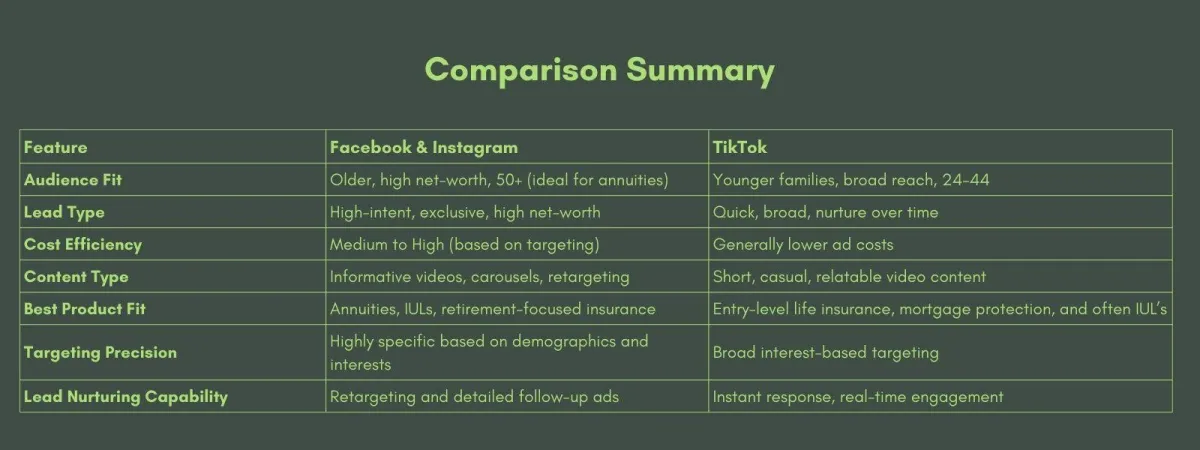

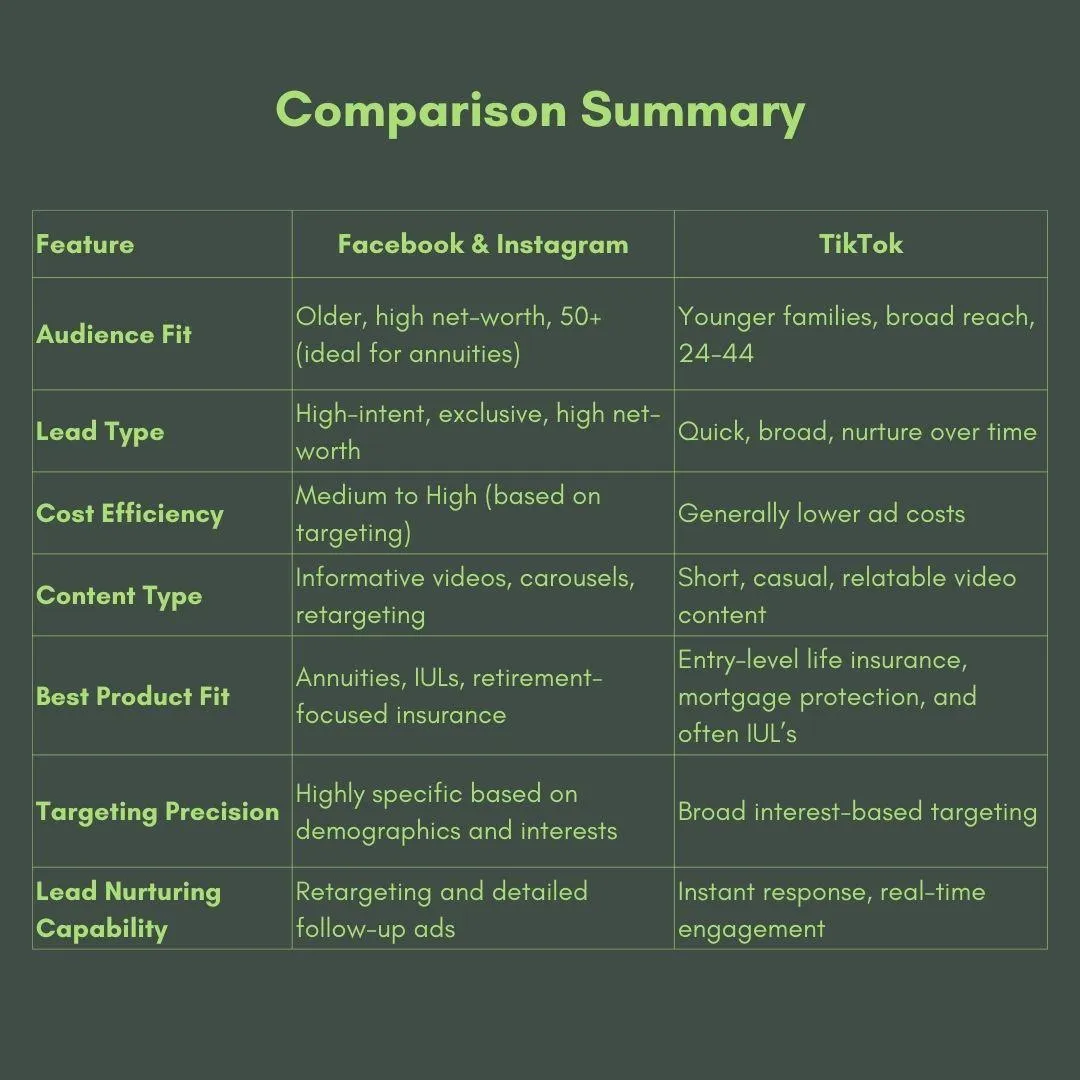

As a life insurance broker, choosing the right social platform is essential for reaching exclusive, high-intent, and high-net-worth prospects, especially when it comes to products like annuities and Indexed Universal Life (IUL) insurance. Facebook, Instagram, and TikTok each have unique strengths when targeting these types of clients, but not every platform works equally well for every audience segment. Drawing on my experience with life insurance marketing at Acropolis Digital LLC, here’s a comparison to help you understand which platform is the best fit for your lead generation strategy.

Facebook & Instagram: Ideal for High-Net-Worth, Mature Audiences

Strengths:

Demographic Targeting: Facebook and Instagram provide granular audience segmentation, which is ideal for reaching high-net-worth individuals aged 50+ who are actively planning for retirement. This group often has the assets and interest in high-value products like annuities.

Detailed Ad Formats and Retargeting: With a variety of ad types—from video and carousel ads to lead generation ads—Facebook and Instagram allow for precise targeting and retargeting, crucial for building trust and creating multiple touchpoints with prospects.

Established Intent Signals: Users on these platforms are accustomed to seeing and interacting with financial content, which can help signal higher intent and readiness to engage with services like IUL policies or annuity consultations.

How Facebook & Instagram Help Generate Exclusive Annuity Leads:

1. Lookalike Audiences for High Net-Worth Individuals: Facebook's advanced algorithm enables brokers to create lookalike audiences based on specific data points, such as previous clients who have shown high intent or high net worth. For annuity leads, this tool helps capture individuals who may be in a similar financial position and interested in tax-advantaged retirement products.

2. Custom Targeting for Age and Financial Interests: The age demographic of 50+ is more active on Facebook, making it a better platform for targeting individuals nearing retirement. Interests related to financial security, retirement planning, and wealth management help refine your target audience.

3. Ad Formats for Nurturing Leads: Carousel ads can showcase different benefits of IULs or annuities, while video ads allow brokers to explain the importance of these products for legacy and retirement planning. Retargeting ads keep potential leads

How Facebook & Instagram Help Generate Exclusive Annuity Leads:

1. Lookalike Audiences for High Net-Worth Individuals: Facebook's advanced algorithm enables brokers to create lookalike audiences based on specific data points, such as previous clients who have shown high intent or high net worth. For annuity leads, this tool helps capture individuals who may be in a similar financial position and interested in tax-advantaged retirement products.

2. Custom Targeting for Age and Financial Interests: The age demographic of 50+ is more active on Facebook, making it a better platform for targeting individuals nearing retirement. Interests related to financial security, retirement planning, and wealth management help refine your target audience.

3. Ad Formats for Nurturing Leads: Carousel ads can showcase different benefits of IULs or annuities, while video ads allow brokers to explain the importance of these products for legacy and retirement planning. Retargeting ads keep potential leads engaged, reminding them of your services at each stage of their decision-making process.

Best Practices:

Use educational video content to establish authority and demonstrate expertise in complex products like annuities.Set up lead generation campaigns optimized for high-net-worth keywords, using clear calls-to-action (CTAs) like “Schedule Your Free Consultation Today.”Leverage Instagram Stories and Facebook retargeting to keep your brand top-of-mind for those who have shown initial interest in financial products.

Audience Fit:

Best For: Older, high-net-worth clients (50+) looking for security and retirement solutions like annuities and IUL.Lead Type: High-intent and exclusive, with a focus on educating clients who are already inclined towards financial planning.

TikTok: Capturing a Younger, Broad Audience for Life Insurance Lead Gen

Strengths:

Massive Organic Reach: TikTok’s algorithm is designed to amplify content quickly, which can help brokers reach a broad, diverse audience, especially those aged 24-44 who are just beginning to consider life insurance options.

Relatable, Video-Centric Content: TikTok thrives on authenticity. Brokers can use short-form video content to humanize their brand, educate, and engage users with financial tips, benefits of life insurance, and short, relatable scenarios.

Cost-Effective Ad Spend: Compared to Facebook and Instagram, TikTok ads can be relatively inexpensive. Brokers can test multiple ad styles and quickly gauge engagement, making it a good platform for experimentation and brand awareness.

How TikTok Generates Real-Time, High-Intent Leads:

1. Educational Content on Financial Security: TikTok’s younger demographic is more likely to interact with engaging, educational videos. Content around financial security for families, mortgage protection, or securing a legacy resonates with users who are beginning to think about the future.

2. Quick Conversions Through Short-Form CTAs: TikTok allows for quick, direct CTAs such as “Learn More” or “Get a Quick Quote,” which can lead directly to a mobile-optimized landing page where users can enter their contact information.

3. Broad Targeting for High-Intent Leads: TikTok’s targeting options are less precise than Facebook’s, but the platform’s algorithm serves your content to a broad audience interested in finance or security, which can result in real-time lead generation if the messaging aligns with your audience.

Best Practices:

- Create short, relatable videos that explain complex products simply—ideal for younger viewers new to financial planning.

-Use a casual tone and keep CTAs simple. Focus on relatable life events, like securing a family’s future or building generational wealth, which appeal to TikTok’s younger demographic.

-Follow up with highly responsive customer service to capture the interest of leads quickly after they express interest.

Audience Fit:

Best For: Younger families, first-time buyers, and individuals new to financial planning, often in the 24-44 age range.

Lead Type: Quick, broad-reach leads that are best nurtured into exclusive prospects over time with further engagement.

Final Thoughts: Which Platform Should You Use?

For life insurance brokers focused on exclusive, high-net-worth annuity and IUL leads, Facebook and Instagram offer more precise targeting options, established audiences in the retirement demographic, and ad formats ideal for high-net-worth prospects. These platforms excel in generating leads who are ready for high-value products and willing to book consultations.

On the other hand, TikTok is a strong contender for broad-reach life insurance lead generation among younger families and individuals new to financial planning. Its rapid engagement model allows brokers to introduce their services to a broader audience, although nurturing will be key to converting these leads into exclusive, high-intent clients over time.

At Acropolis Digital LLC, me and my team specialize in crafting campaigns for each platform’s unique strengths, helping you generate exclusive, real-time leads optimized for conversion. If you’re ready to leverage the power of social media for high-quality annuity and life insurance leads, book a call with us today.

Want to learn how?

Discover how the Acropolis Digital can help grow your annuity business.

Join Trevor for a quick, 30-minute video call to learn strategies that drive leads, streamline client acquisition, and boost your revenue.

Featured

How Life Insurance Brokers Can Generate High-Quality Leads Using Video Ads...

Featured

Google Ads vs. Facebook Ads for Annuity Lead Generation: Which One Works Better?...

Featured

Facebook and Instagram vs. TikTok Ads for Life Insurance Brokers...

Featured

Turning Life and Annuity Clients into Referral Partners...

Featured

The Power of the Quiz Funnel for IUL and Annuity Lead Generation...

Featured

How to Generate Life Insurance Leads on TikTok...

Facebook and Instagram vs. TikTok Ads for Life Insurance Brokers: A Guide to Generating High-Intent, High-Net-Worth Annuity and IUL Leads

ACROPOLIS DIGITAL LLC | NOVEMBER 22, 2024 | BY TREVOR BROWN

As a life insurance broker, choosing the right social platform is essential for reaching exclusive, high-intent, and high-net-worth prospects, especially when it comes to products like annuities and Indexed Universal Life (IUL) insurance. Facebook, Instagram, and TikTok each have unique strengths when targeting these types of clients, but not every platform works equally well for every audience segment. Drawing on my experience with life insurance marketing at Acropolis Digital LLC, here’s a comparison to help you understand which platform is the best fit for your lead generation strategy.

Facebook & Instagram: Ideal for High-Net-Worth, Mature Audiences

Strengths:

Demographic Targeting: Facebook and Instagram provide granular audience segmentation, which is ideal for reaching high-net-worth individuals aged 50+ who are actively planning for retirement. This group often has the assets and interest in high-value products like annuities.

Detailed Ad Formats and Retargeting: With a variety of ad types—from video and carousel ads to lead generation ads—Facebook and Instagram allow for precise targeting and retargeting, crucial for building trust and creating multiple touchpoints with prospects.

Established Intent Signals: Users on these platforms are accustomed to seeing and interacting with financial content, which can help signal higher intent and readiness to engage with services like IUL policies or annuity consultations.

How Facebook & Instagram Help Generate Exclusive Annuity Leads:

1. Lookalike Audiences for High Net-Worth Individuals: Facebook's advanced algorithm enables brokers to create lookalike audiences based on specific data points, such as previous clients who have shown high intent or high net worth. For annuity leads, this tool helps capture individuals who may be in a similar financial position and interested in tax-advantaged retirement products.

2. Custom Targeting for Age and Financial Interests: The age demographic of 50+ is more active on Facebook, making it a better platform for targeting individuals nearing retirement. Interests related to financial security, retirement planning, and wealth management help refine your target audience.

3. Ad Formats for Nurturing Leads: Carousel ads can showcase different benefits of IULs or annuities, while video ads allow brokers to explain the importance of these products for legacy and retirement planning. Retargeting ads keep potential leads

How Facebook & Instagram Help Generate Exclusive Annuity Leads:

1. Lookalike Audiences for High Net-Worth Individuals: Facebook's advanced algorithm enables brokers to create lookalike audiences based on specific data points, such as previous clients who have shown high intent or high net worth. For annuity leads, this tool helps capture individuals who may be in a similar financial position and interested in tax-advantaged retirement products.

2. Custom Targeting for Age and Financial Interests: The age demographic of 50+ is more active on Facebook, making it a better platform for targeting individuals nearing retirement. Interests related to financial security, retirement planning, and wealth management help refine your target audience.

3. Ad Formats for Nurturing Leads: Carousel ads can showcase different benefits of IULs or annuities, while video ads allow brokers to explain the importance of these products for legacy and retirement planning. Retargeting ads keep potential leads

How Facebook & Instagram Help Generate Exclusive Annuity Leads:

1. Lookalike Audiences for High Net-Worth Individuals: Facebook's advanced algorithm enables brokers to create lookalike audiences based on specific data points, such as previous clients who have shown high intent or high net worth. For annuity leads, this tool helps capture individuals who may be in a similar financial position and interested in tax-advantaged retirement products.

2. Custom Targeting for Age and Financial Interests: The age demographic of 50+ is more active on Facebook, making it a better platform for targeting individuals nearing retirement. Interests related to financial security, retirement planning, and wealth management help refine your target audience.

3. Ad Formats for Nurturing Leads: Carousel ads can showcase different benefits of IULs or annuities, while video ads allow brokers to explain the importance of these products for legacy and retirement planning. Retargeting ads keep potential leads engaged, reminding them of your services at each stage of their decision-making process.

Best Practices:

Use educational video content to establish authority and demonstrate expertise in complex products like annuities.Set up lead generation campaigns optimized for high-net-worth keywords, using clear calls-to-action (CTAs) like “Schedule Your Free Consultation Today.”Leverage Instagram Stories and Facebook retargeting to keep your brand top-of-mind for those who have shown initial interest in financial products.

Audience Fit:

Best For: Older, high-net-worth clients (50+) looking for security and retirement solutions like annuities and IUL.Lead Type: High-intent and exclusive, with a focus on educating clients who are already inclined towards financial planning.

TikTok: Capturing a Younger, Broad Audience for Life Insurance Lead Gen

Strengths:

Massive Organic Reach: TikTok’s algorithm is designed to amplify content quickly, which can help brokers reach a broad, diverse audience, especially those aged 24-44 who are just beginning to consider life insurance options.

Relatable, Video-Centric Content: TikTok thrives on authenticity. Brokers can use short-form video content to humanize their brand, educate, and engage users with financial tips, benefits of life insurance, and short, relatable scenarios.

Cost-Effective Ad Spend: Compared to Facebook and Instagram, TikTok ads can be relatively inexpensive. Brokers can test multiple ad styles and quickly gauge engagement, making it a good platform for experimentation and brand awareness.

How TikTok Generates Real-Time, High-Intent Leads:

1. Educational Content on Financial Security: TikTok’s younger demographic is more likely to interact with engaging, educational videos. Content around financial security for families, mortgage protection, or securing a legacy resonates with users who are beginning to think about the future.

2. Quick Conversions Through Short-Form CTAs: TikTok allows for quick, direct CTAs such as “Learn More” or “Get a Quick Quote,” which can lead directly to a mobile-optimized landing page where users can enter their contact information.

3. Broad Targeting for High-Intent Leads: TikTok’s targeting options are less precise than Facebook’s, but the platform’s algorithm serves your content to a broad audience interested in finance or security, which can result in real-time lead generation if the messaging aligns with your audience.

Best Practices:

- Create short, relatable videos that explain complex products simply—ideal for younger viewers new to financial planning.

-Use a casual tone and keep CTAs simple. Focus on relatable life events, like securing a family’s future or building generational wealth, which appeal to TikTok’s younger demographic.

-Follow up with highly responsive customer service to capture the interest of leads quickly after they express interest.

Audience Fit:

Best For: Younger families, first-time buyers, and individuals new to financial planning, often in the 24-44 age range.

Lead Type: Quick, broad-reach leads that are best nurtured into exclusive prospects over time with further engagement.

Final Thoughts: Which Platform Should You Use?

For life insurance brokers focused on exclusive, high-net-worth annuity and IUL leads, Facebook and Instagram offer more precise targeting options, established audiences in the retirement demographic, and ad formats ideal for high-net-worth prospects. These platforms excel in generating leads who are ready for high-value products and willing to book consultations.

On the other hand, TikTok is a strong contender for broad-reach life insurance lead generation among younger families and individuals new to financial planning. Its rapid engagement model allows brokers to introduce their services to a broader audience, although nurturing will be key to converting these leads into exclusive, high-intent clients over time.

At Acropolis Digital LLC, me and my team specialize in crafting campaigns for each platform’s unique strengths, helping you generate exclusive, real-time leads optimized for conversion. If you’re ready to leverage the power of social media for high-quality annuity and life insurance leads, book a call with us today.

Featured

Marketing Maverick: Acropolis Digital’s...

Featured

The Acropolis Digital LLC Announces ...

Featured

Why Facebook, TikTok, and Instagram Lead Gen Is Better...

Featured

How Life Insurance Brokers Can Generate High-Quality Leads Using Video Ads...

Featured

Google Ads vs. Facebook Ads for Annuity Lead Generation: Which One Works Better?...

Featured

Facebook and Instagram vs. TikTok Ads for Life Insurance Brokers...

Featured

Turning Life and Annuity Clients into Referral Partners...

Featured

The Power of the Quiz Funnel for IUL and Annuity Lead Generation...

Featured

How to Generate Life Insurance Leads on TikTok...

Featured

Advanced EMA Marketing Strategies: How to Optimize & Scale...

Featured

Advanced SMS Marketing Strategies for Life Insurance & Annuity Sales...

Featured

Beginner-Friendly SMS Marketing Guide for Life Insurance & Annuity Sales...

Featured

Boost Your Life Insurance Sales...

Featured

How to Audit Your Own Tonality to 10X Your Life and Annuity Sales ...

Featured

How to get Free Life Insurance & Annuity Leads using Meetup & Alignable ...

Featured

How to Increase Your Life Insurance Commissions: Top 5 Strategies for Bigger Payouts...

Featured

How to Recruit Life Insurance Agents Using Meetup & Alignable (50+ Recruits Per Month)...

Featured

I Bought Jeremy Miner’s Course & Watched all 4,185 of His Reels – Here Are the Top 10 Lessons to Increase Your Life Insurance Sales...

Want to learn how?

Discover how the Acropolis Digital can help grow your annuity business.

Join Trevor for a quick, 30-minute video call to learn strategies that drive leads, streamline client acquisition, and boost your revenue.

©2024 & Beyond theacropolisdigital.com

Copyright Acropolis Digital LLC, all Rights Reserved.

©2024 & Beyond theacropolisdigital.com

Copyright Acropolis Digital LLC, all Rights Reserved.