Google Ads vs. Facebook Ads for Annuity Lead Generation: Which One Works Better?

ACROPOLIS DIGITAL LLC | DECEMBER 2, 2024 | BY TREVOR BROWN

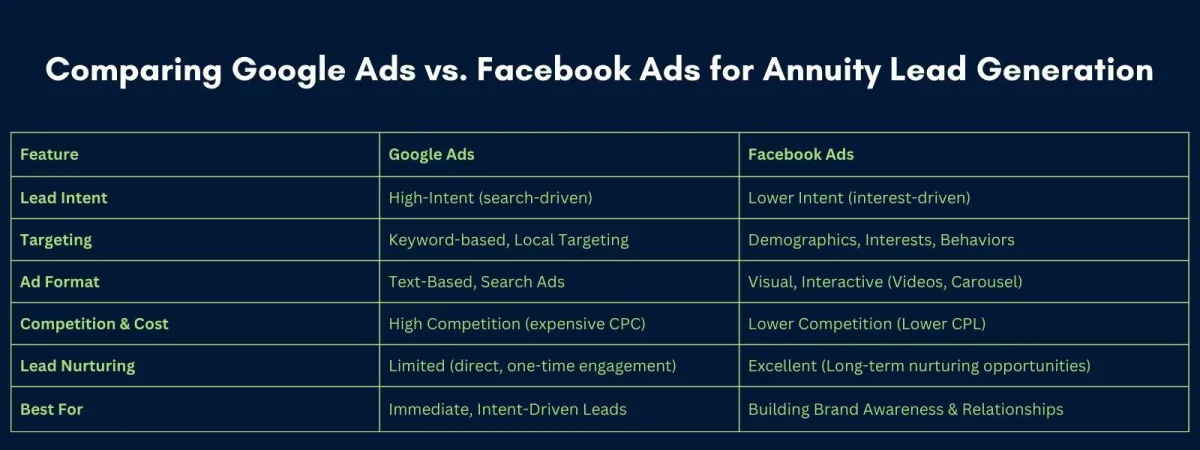

When it comes to generating leads for annuities, you might wonder whether Google Ads or Facebook Ads will deliver better results. Both platforms have their unique strengths and offer different approaches for reaching your ideal prospects. The key is understanding which platform works best for high-net-worth clients and high-intent leads—and how each can be leveraged to your advantage.

In this article, we’ll break down the pros and cons of Google Ads and Facebook Ads in the context of annuity marketing to help you make an informed decision.

Google Ads for Annuity Lead Generation: Intent-Driven, Search-Based

How Google Ads Work

Google Ads are search-driven, meaning they show up when people actively search for something related to your product or service. With Google, people are typing in specific keywords like “best annuity rates” or “safe retirement options.” This shows that they already have a high intent to find solutions and make a decision.

Pros of Google Ads for Annuities

1. High-Intent Leads: Google Ads allows you to target people who are already searching for annuity-related products or retirement planning. These prospects are often further down the sales funnel and ready to engage.

2. Keyword Targeting: You can target highly specific keywords that focus on people actively seeking information about annuities, such as “fixed indexed annuities,” “best annuities for retirement,” or “guaranteed lifetime income.”

3. Local Targeting: If you're targeting a specific geographic region, Google Ads offers excellent local targeting options, allowing you to appear for searches like “annuity advisors in [your city]” for potential clients looking for a local expert.

4. Proven ROI: Google’s search ads generally have a strong track record of generating high-intent leads for industries like annuities, where prospects are actively researching options.

Cons of Google Ads for Annuities

1. High Competition and Cost: Annuity-related keywords are often highly competitive, especially when trying to rank for broader terms. Larger insurance carriers often dominate these searches, driving up costs per click (CPC).

2. Short-Term Focus: While Google Ads can drive immediate traffic, it doesn't necessarily build a long-term relationship with prospects. Once they click through, you have to quickly convert them into a lead or sale.

3. Complexity: Setting up and optimizing Google Ads campaigns requires a solid understanding of keyword research, ad copywriting, and budget management. Mistakes here can result in wasted ad spend.

Facebook Ads for Annuity Lead Generation: Visual and Behavioral Targeting

How Facebook Ads Work

Facebook Ads take a different approach by targeting people based on their interests, demographics, and behavioral data, rather than what they are actively searching for. On Facebook, you’re pushing ads to an audience that may not necessarily be searching for annuities but could benefit from learning about your products.

Pros of Facebook Ads for Annuities

1. Advanced Targeting: Facebook offers advanced targeting options where you can refine your audience based on their age, income, marital status, and interests (like retirement planning, investment, financial security, etc.). This makes it easier to target people likely to be interested in annuity products without relying on them actively searching for your services.

2. Custom Audiences: With Facebook, you can build custom audiences based on website visitors, email lists, or those who’ve interacted with your Facebook content. This helps you target people who are already familiar with your brand, increasing the chances of conversion.

3. Engaging Visuals: Facebook Ads are highly visual and can include videos, carousel ads, or single images to grab attention and explain complex annuity products in an easy-to-understand format. You can use these ads to build a connection with your audience, showcase success stories, and explain how annuities work in a way that resonates with them.

4. Lower Cost Per Lead (CPL): Compared to Google Ads, Facebook Ads can have a lower CPL, especially if you’re targeting niche groups or using Facebook’s Lead Generation Ads, which allow users to opt in directly within the app without leaving the platform.

5. Build Long-Term Relationships: Facebook Ads help you nurture potential clients over time. By running educational or informative ads, you can build trust and keep your brand top-of-mind as prospects begin their decision-making process.

Cons of Facebook Ads for Annuities

1. Lower Intent: Since Facebook Ads are shown to users based on interests and behaviors (not search intent), the audience may not be as actively engaged or ready to convert as those who use Google. This means you may need to work harder to nurture these leads into high-intent prospects.

2. Ad Fatigue: People on Facebook are constantly scrolling through their feeds. Your ads need to be creative and engaging to stand out. With time, ads can become stale, and it can be hard to maintain the same level of performance if the audience becomes disengaged.

3. Privacy Concerns: As social media platforms become more sensitive to privacy issues, targeting capabilities may become restricted in the future. This could affect your ability to reach high-net-worth individuals or narrow down your audience in specific ways.

Conclusion: Which Is Better for Annuities?

Both Google Ads and Facebook Ads have their strengths when it comes to generating leads for annuities. If you’re looking for high-intent, ready-to-purchase leads who are actively searching for annuity solutions, Google Ads may be the better choice. However, if you’re looking to target specific demographics, build brand awareness, and engage with a broader audience at a lower cost, Facebook Ads might be more effective.

In the end, the best approach is often a combination of both. You can use Google Ads to capture immediate intent and Facebook Ads to build a long-term relationship with potential clients. By leveraging the strengths of each platform, you can generate high-quality, exclusive, real-time leads for your annuity products.

Google Ads vs. Facebook Ads for Annuity Lead Generation: Which One Works Better?

ACROPOLIS DIGITAL LLC | NOVEMBER 22, 2024 | BY TREVOR BROWN

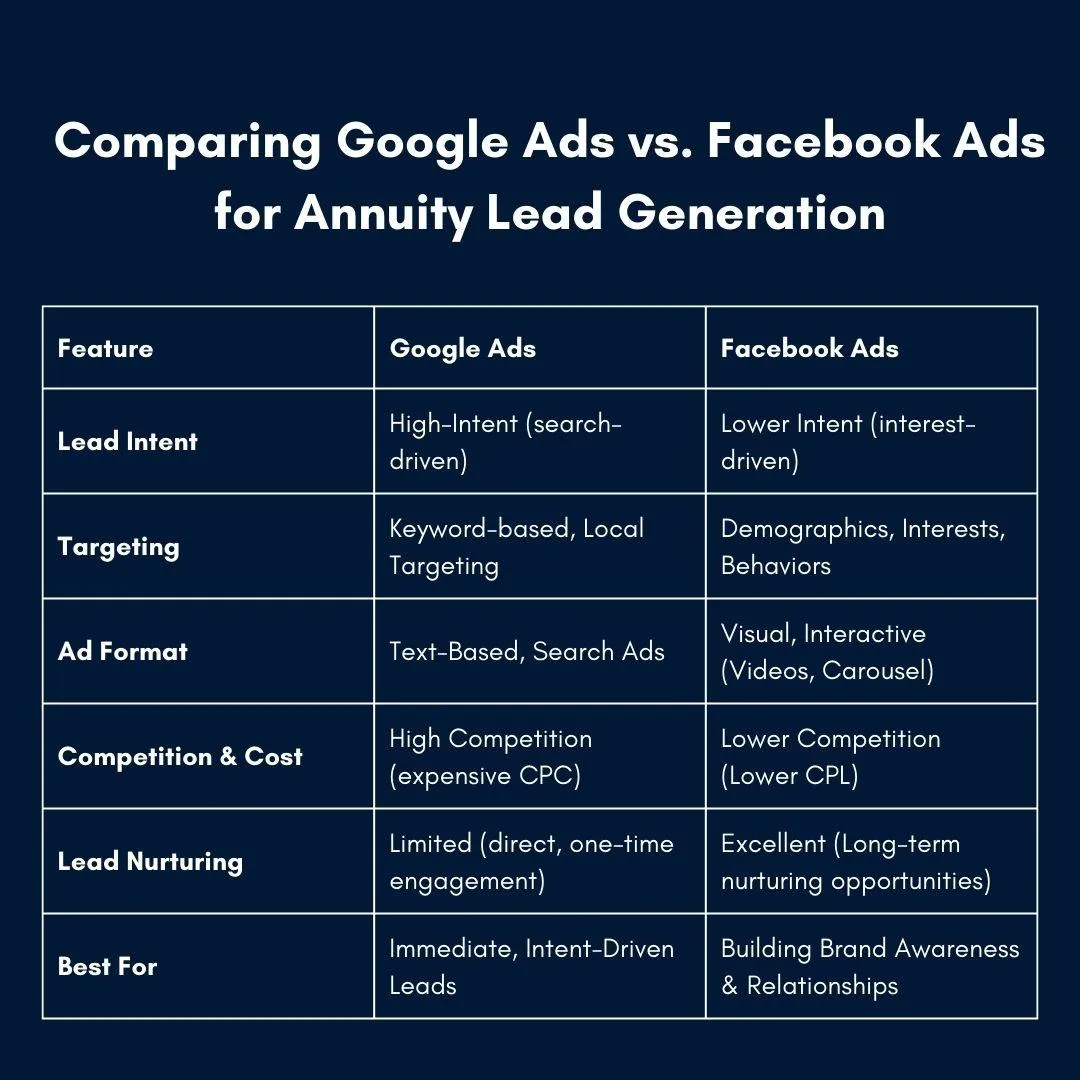

When it comes to generating leads for annuities, you might wonder whether Google Ads or Facebook Ads will deliver better results. Both platforms have their unique strengths and offer different approaches for reaching your ideal prospects. The key is understanding which platform works best for high-net-worth clients and high-intent leads—and how each can be leveraged to your advantage.

In this article, we’ll break down the pros and cons of Google Ads and Facebook Ads in the context of annuity marketing to help you make an informed decision.

Google Ads for Annuity Lead Generation: Intent-Driven, Search-Based

How Google Ads Work

Google Ads are search-driven, meaning they show up when people actively search for something related to your product or service. With Google, people are typing in specific keywords like “best annuity rates” or “safe retirement options.” This shows that they already have a high intent to find solutions and make a decision.

Pros of Google Ads for Annuities

1. High-Intent Leads: Google Ads allows you to target people who are already searching for annuity-related products or retirement planning. These prospects are often further down the sales funnel and ready to engage.

2. Keyword Targeting: You can target highly specific keywords that focus on people actively seeking information about annuities, such as “fixed indexed annuities,” “best annuities for retirement,” or “guaranteed lifetime income.”

3. Local Targeting: If you're targeting a specific geographic region, Google Ads offers excellent local targeting options, allowing you to appear for searches like “annuity advisors in [your city]” for potential clients looking for a local expert.

4. Proven ROI: Google’s search ads generally have a strong track record of generating high-intent leads for industries like annuities, where prospects are actively researching options.

Cons of Google Ads for Annuities

1. High Competition and Cost: Annuity-related keywords are often highly competitive, especially when trying to rank for broader terms. Larger insurance carriers often dominate these searches, driving up costs per click (CPC).

2. Short-Term Focus: While Google Ads can drive immediate traffic, it doesn't necessarily build a long-term relationship with prospects. Once they click through, you have to quickly convert them into a lead or sale.

3. Complexity: Setting up and optimizing Google Ads campaigns requires a solid understanding of keyword research, ad copywriting, and budget management. Mistakes here can result in wasted ad spend.

Facebook Ads for Annuity Lead Generation: Visual and Behavioral Targeting

How Facebook Ads Work

Facebook Ads take a different approach by targeting people based on their interests, demographics, and behavioral data, rather than what they are actively searching for. On Facebook, you’re pushing ads to an audience that may not necessarily be searching for annuities but could benefit from learning about your products.

Pros of Facebook Ads for Annuities

1. Advanced Targeting: Facebook offers advanced targeting options where you can refine your audience based on their age, income, marital status, and interests (like retirement planning, investment, financial security, etc.). This makes it easier to target people likely to be interested in annuity products without relying on them actively searching for your services.

2. Custom Audiences: With Facebook, you can build custom audiences based on website visitors, email lists, or those who’ve interacted with your Facebook content. This helps you target people who are already familiar with your brand, increasing the chances of conversion.

3. Engaging Visuals: Facebook Ads are highly visual and can include videos, carousel ads, or single images to grab attention and explain complex annuity products in an easy-to-understand format. You can use these ads to build a connection with your audience, showcase success stories, and explain how annuities work in a way that resonates with them.

4. Lower Cost Per Lead (CPL): Compared to Google Ads, Facebook Ads can have a lower CPL, especially if you’re targeting niche groups or using Facebook’s Lead Generation Ads, which allow users to opt in directly within the app without leaving the platform.

5. Build Long-Term Relationships: Facebook Ads help you nurture potential clients over time. By running educational or informative ads, you can build trust and keep your brand top-of-mind as prospects begin their decision-making process.

Cons of Facebook Ads for Annuities

1. Lower Intent: Since Facebook Ads are shown to users based on interests and behaviors (not search intent), the audience may not be as actively engaged or ready to convert as those who use Google. This means you may need to work harder to nurture these leads into high-intent prospects.

2. Ad Fatigue: People on Facebook are constantly scrolling through their feeds. Your ads need to be creative and engaging to stand out. With time, ads can become stale, and it can be hard to maintain the same level of performance if the audience becomes disengaged.

3. Privacy Concerns: As social media platforms become more sensitive to privacy issues, targeting capabilities may become restricted in the future. This could affect your ability to reach high-net-worth individuals or narrow down your audience in specific ways.

Conclusion: Which Is Better for Annuities?

Both Google Ads and Facebook Ads have their strengths when it comes to generating leads for annuities. If you’re looking for high-intent, ready-to-purchase leads who are actively searching for annuity solutions, Google Ads may be the better choice. However, if you’re looking to target specific demographics, build brand awareness, and engage with a broader audience at a lower cost, Facebook Ads might be more effective.

In the end, the best approach is often a combination of both. You can use Google Ads to capture immediate intent and Facebook Ads to build a long-term relationship with potential clients. By leveraging the strengths of each platform, you can generate high-quality, exclusive, real-time leads for your annuity products.

Featured

Marketing Maverick: Acropolis Digital’s...

Featured

The Acropolis Digital LLC Announces ...

Featured

Why Facebook, TikTok, and Instagram Lead Gen Is Better...

Featured

How Life Insurance Brokers Can Generate High-Quality Leads Using Video Ads...

Featured

Google Ads vs. Facebook Ads for Annuity Lead Generation: Which One Works Better?...

Featured

Facebook and Instagram vs. TikTok Ads for Life Insurance Brokers...

Featured

Turning Life and Annuity Clients into Referral Partners...

Featured

The Power of the Quiz Funnel for IUL and Annuity Lead Generation...

Featured

How to Generate Life Insurance Leads on TikTok...

Featured

Advanced EMA Marketing Strategies: How to Optimize & Scale...

Featured

Advanced SMS Marketing Strategies for Life Insurance & Annuity Sales...

Featured

Beginner-Friendly SMS Marketing Guide for Life Insurance & Annuity Sales...

Featured

Boost Your Life Insurance Sales...

Featured

How to Audit Your Own Tonality to 10X Your Life and Annuity Sales ...

Featured

How to get Free Life Insurance & Annuity Leads using Meetup & Alignable ...

Featured

How to Increase Your Life Insurance Commissions: Top 5 Strategies for Bigger Payouts...

Featured

How to Recruit Life Insurance Agents Using Meetup & Alignable (50+ Recruits Per Month)...

Featured

I Bought Jeremy Miner’s Course & Watched all 4,185 of His Reels – Here Are the Top 10 Lessons to Increase Your Life Insurance Sales...

Want to learn how?

Discover how the Acropolis Digital can help grow your annuity business.

Join Trevor for a quick, 30-minute video call to learn strategies that drive leads, streamline client acquisition, and boost your revenue.

Want to learn how?

Discover how the Acropolis Digital can help grow your annuity business.

Join Trevor for a quick, 30-minute video call to learn strategies that drive leads, streamline client acquisition, and boost your revenue.

Featured

How Life Insurance Brokers Can Generate High-Quality Leads Using Video Ads...

Featured

Google Ads vs. Facebook Ads for Annuity Lead Generation: Which One Works Better?...

Featured

Facebook and Instagram vs. TikTok Ads for Life Insurance Brokers...

Featured

Turning Life and Annuity Clients into Referral Partners...

Featured

The Power of the Quiz Funnel for IUL and Annuity Lead Generation...

Featured

How to Generate Life Insurance Leads on TikTok...

©2024 & Beyond theacropolisdigital.com

Copyright Acropolis Digital LLC, all Rights Reserved.

©2024 & Beyond theacropolisdigital.com

Copyright Acropolis Digital LLC, all Rights Reserved.